We endeavor to let people make better economic decisions, so we analyzed multiple things to influence an informed financial institutions. We experienced the next details ahead of looking at an educated highest-chance loan unsecured loan-taking sites:

Because these loans are risky, you need to meticulously measure the lending options offered

- Fixed-rate Apr: The fresh varying Apr prices changes in the timeline of one’s mortgage, but there is however a predetermined-rates Annual percentage rate one hair for the just like the an interest rate into the overall duration of your loan. I felt the latest financing communities providing repaired price Annual percentage rate to ensure you know the monthly obligations won’t changes. This way, you might package your finances correctly.

- Loan identity lengths: I well-known the individuals credit sites that offer versatile cost lengths. If you get long-title lengths getting installment out-of money, it will become simpler to plan the newest budget while making costs for the go out. The fresh new lending companies i’ve examined work on lenders that primarily provide much time-name lengths.

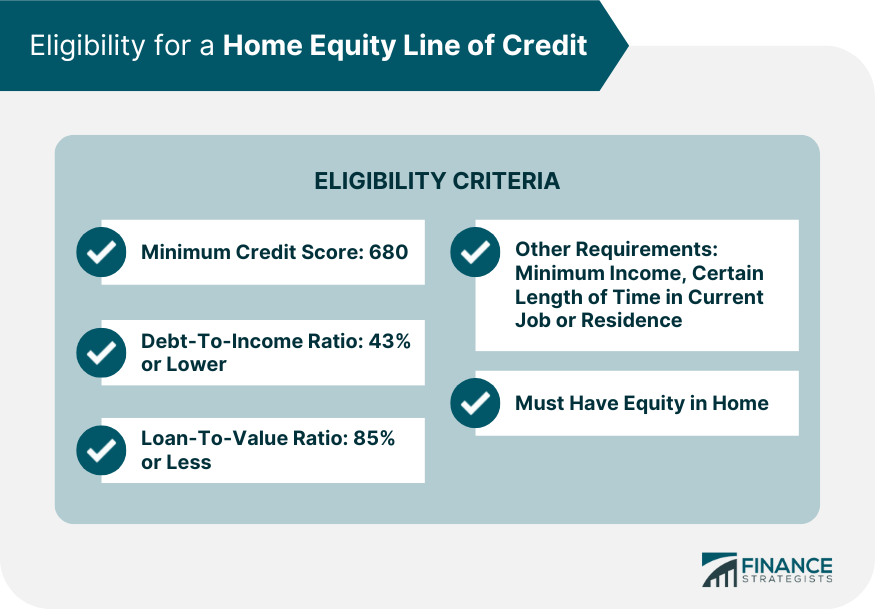

- Credit score standards: Your own qualifications relies on your credit rating, and your possibilities get restricted for those who have a reduced score. Yet not, we have picked those individuals platforms that offer fund to individuals with low credit ratings. With this credit networks, you’ve still got a window of opportunity for qualifying towards the loans.

- Trustworthiness: One of the many points to consider ‘s the trustworthiness of a lender. A patio that doesn’t generate the pointers easily obtainable so you’re able to their users was dubious. Therefore, we picked merely clear financing networking sites with respect to its functions and operations.

- Customer service: To find the best consumer sense, i usually find programs providing customer care gadgets featuring you to definitely describe the borrowed funds techniques. As well as, we desired men and women lending networks with a lot of positive ratings of met customers.

A premier-risk personal loan is a card or investment unit that’s noticed one which is much more browsing score standard as versus conventional funds. To pick the best payday loans which have secured acceptance regarding lead loan providers, i’ve gathered a listing of a few. Following the certainly are the items you need to see:

Mainly because fund is high-risk, you must meticulously gauge the lending products offered

- Variety of Less than perfect credit Loans

Before you choose a loan provider to possess large-exposure loans, you must consider carefully your options for the sorts of fund offered. An unsecured loan is helpful if you prefer bucks to meet up with individual costs, you might also want to be able to pay it back punctually. However, if not spend some time and pick financing inside the rush, you will be troubled together with your credit history. Some of the well-known choices that are offered having poor credit money is actually payday loans, title funds, unsecured unsecured loans, and you may pawn store yards. Windsor savings and installment loan Pay day loan was brief-name funds you have to pay-off inside a fortnight. The new identity loans wanted security to provide finance. Moreover, pawn store finance is actually personal loans, however security is still inside it. The fresh new guarantee here should be almost everything you possess which can end up being beneficial with the pawn store.

Because these loans was risky, you ought to cautiously evaluate the financial loans offered

- Financing numbers

You ought to make sure the financial you may be handling gives the mortgage number you would expect. For-instance, specific lending companies partner having loan providers offering finance out of upwards to $10,100000, and others will give financing of up to $thirty five,100. Ergo, you ought to take into account the loan amount prior to acknowledging a deal. You could also thought quick-term finance, including, a $a thousand mortgage to own conference an urgent individual expense. However, what if the lending company doesn’t render a loan amount away from $1000? You are able to thought lenders which have large loan products, particularly when you are searching toward debt consolidating finance.

Deja una respuesta