Signature loans may be the wade-so you can option for meeting economic desires and requirements. He or she is unsecured loans plus don’t wanted people security. They are utilised a variety of motives eg throwing a huge marriage, travel to help you a unique place, fulfilling unanticipated medical emergencies, otherwise remodeling your house so you can modify the looks.

One of the primary personal bank loan gurus try its troubles-free app techniques. As well as, a personal bank loan try smoother because you is repay it more an occasion into the pouch-friendly installment payments.

Just how can personal loans functions?

Signature loans are like most other finance. You can contact a lender otherwise financial institution to help you apply for a similar. 2nd, complete all of the required documents listed of the bank. The financial institution verifies what your make available to ensure it is specific and you will true. In addition it checks their creditworthiness before you make that loan provide. For those who take on the offer, the lender transfers the mortgage total your bank account, and you may use it according to your own needs.

The fresh new borrower needs to pay off the mortgage count inside equated monthly payments (EMIs). The fresh new payment amount is actually calculated in accordance with the amount borrowed, interest rate, and you can mortgage period.

5 reasons why you should score an unsecured loan

You need to consider carefully your financial situation before taking with the financing. A consumer loan assists money a huge buy that you dont pay for upfront. They truly are:

step one. House restoration: Personal loans are the most effective answer to pay for upgrading their household or completing requisite solutions. 2. Emergency expenditures: A personal bank loan try a low-pricing solution to see a crisis, including the funeral of someone close or abrupt scientific expenses. step three. Swinging will set you back: For those who you should never have the money for a district otherwise a long-point disperse, you need to a personal loan to cover new swinging costs. 4. Travel expenditures: The expense installment loans Augusta no credit check of the average trips will most likely not want delivering good personal loan. However,, let’s say we would like to embark on a luxury sail? A personal bank loan will come in useful in order to fulfil for example vacation goals. 5. Matrimony can cost you: A consumer loan allows possible lovers to invest in larger-ticket items like the wedding planner, area, brides and you will grooms skirt, etc.

Finest nine personal bank loan experts

step one. Hassle-free documentation One of the many personal bank loan positives are minimal records. If you incorporate on line, the fresh new records is entirely digital. You could potentially publish the required files with your form. The process is entirely paperless. Some lenders also have a help to own home file collection. Toward processes, banks and you can financial institutions request you to fill out proof age, address, bank account info, salary slides, income tax efficiency, credit rating, an such like.

2. Quick disbursal The fresh new disbursal of a home loan requires doing 3 in order to 4 weeks. In addition, a consumer loan requires only 24 hours to 72 times. Thus, they are finest financial product having conference urgent bucks or fee standards. However, you need to meet with the qualifications conditions and also have a borrowing from the bank score to get your loan disbursed rapidly.

step 3. Zero security expected Signature loans try signature loans. Hence, you don’t need to include people collateral given that safeguards getting default or non-percentage away from dues at the avoid. This particular aspect of unsecured loans means they are offered to men and women having a routine source of income and you can an excellent credit score.

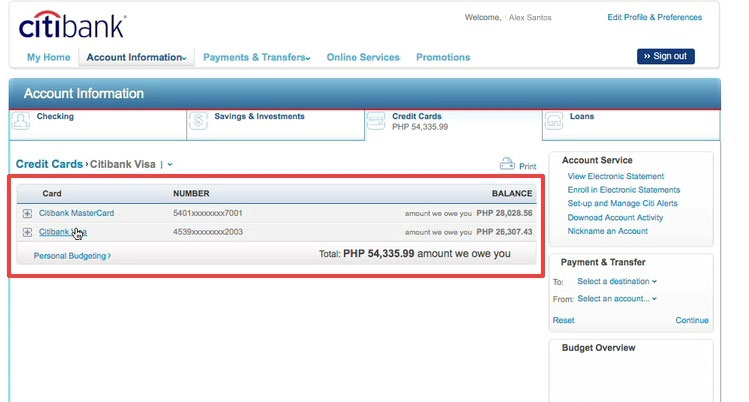

4. Advice about debt consolidating Other essential personal bank loan work with try its ability to obvious expense. For those who have costs such as for instance secured loans otherwise higher-interest handmade cards, you should use the personal mortgage to pay off the fresh expenses and you can dump debts from the profile. The interest costs on personal loans is actually less than with the borrowing notes. Very, you can utilize the low-appeal monetary tool to pay off highest-appeal loans.

Deja una respuesta