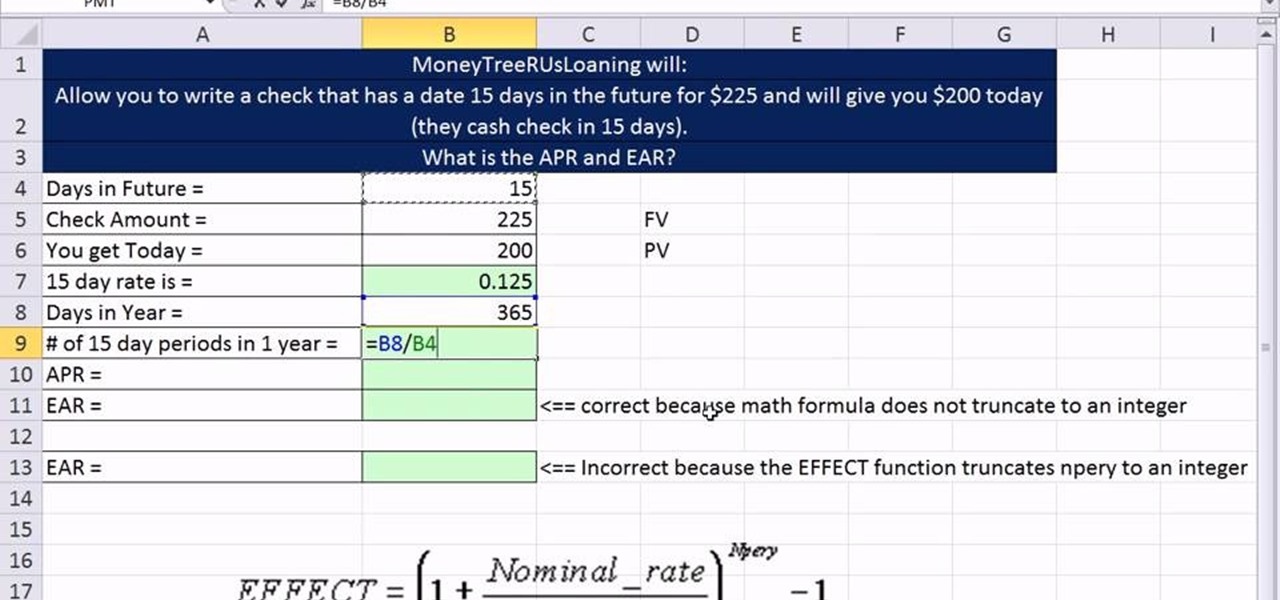

Payday loans online target individuals with bad credit and frequently state to own zero lowest credit rating and other standards so you can meet the requirements. The new downside? The typical Annual percentage rate of payday loans ranges for the various, which means you will be spending more for the focus than in the total amount your debt. Pay-day lenders tend to victimize some one struggling to find currency Extra resources, but their payment conditions are impossible to fulfill.

Actually crappy-borrowing repayment loans top aside which have an apr out of %, causing them to much more affordable than just possibly the best payday loan providing. And lots of some body usually see it is simpler to pay back financing having multiple small payments in place of an individual large sum. Stretched loan terms normally disappear these types of monthly premiums after that, putting some cost mortgage a lot more in balance.

If you are looking to have an alternative to instantaneous online payday loans, consult your borrowing connection. Many have started providing pay-day-alternative finance giving small-term financial support with a maximum Apr out-of twenty eight%.

Are there No-Credit-Take a look at Repayment Loans?

Certain loan providers uses just a soft credit score assessment whenever providing that loan without asking for a hard pull-on your credit score.

No-credit-glance at cost money are like pay day loan because it promote solutions to individuals having bad credit, nevertheless cons tend to outweigh the benefits. No-credit-check cost fund can sometimes include a very high origination fee and punitive rates of interest. Instead, communicate with a credit partnership to work out a much better offer.

Manage Payment Funds Damage Your Borrowing?

The only real almost every other way that a repayment financing is hurt your borrowing from the bank is when your miss your repayments. You can try to increase your loan terminology to lessen the newest monthly payments and give a wide berth to so it from happening.

What Minimum Credit score How would you like for a payment Loan?

Different loan providers possess other requirements. Extremely will need a rating of at least 600, while others are more stringent and also minimums from 640 otherwise 680.

Might you Pay off a payment Mortgage Early?

Sure. But not, be sure to realize the loan terms and conditions because specific loan providers have charges getting very early repayments. Most you should never, but just such as the origination commission, understanding these penalties helps you prevent dirty surprises regarding the coming.

- Zero lowest yearly money criteria

Because of Upstart’s book underwriting design, the firm doesn’t have a minimum credit score limitation. Rather, the financial institution considers a number of other items to determine your own qualification to have a consumer loan.

In general, individuals can’t use SoFi signature loans first off a new team, pick a home, otherwise fund financial support otherwise bonds sales.

Annual percentage rate Ranges

LendingClub’s Annual percentage rate initiate during the eight.04% and you will caps aside in the %. There’s no discount for choosing the fresh autopay option, however, people that have relatively a good credit score ratings can frequently be eligible for a nice-looking interest rate.

Just like the a consumer loan means an elevated chance towards the financial, interest rates are usually large. Doing so lets the lender so you’re able to mitigate chance by the gathering way more money regarding lifespan of the loan.

Origination Costs

You can listed below are some aggregator internet to help with new app techniques. The websites send your data to various loan providers and you will become straight back which have rates that you could upcoming look at at your amusement. It streamlines the application form process helping you can see an informed fixed-speed financing to your requirements having reduced effort and time.

Of a lot lenders give formal cost financing that assist anybody combine their financial obligation. The financial institution have a tendency to distribute the borrowed funds count within various creditors, allowing you to work at paying down one to mortgage instead of multiple creditors. Below are a few all of our help guide to an informed debt consolidating fund to have addiitional information.

When you are not able to meet up with the lowest credit rating must be eligible for an unsecured loan, you could think that an online payday loan is an excellent solution.

Deja una respuesta