Work

They will glance at the time of the work, the kind of a job (full-time, self-operating and the like) as well as the globe you work with. Loan providers fundamentally require the earlier in the day 90 days regarding payslips plus your residence loan application. If you’re self-working, you will possibly not be able to supply these types of docume nts, and thus are expected to incorporate almost every other data such as for example your own tax returns.

You will constantly should have experienced your position for around six months before applying to own home financing, but in a comparable work for a few age will likely be useful. Simply because the financial institution are going to be assured that you’ll keeps constant employment and therefore money when you take on your own domestic financing. Self-working individuals could need to jump due to more hoops to get accepted to possess a home loan.

Possessions and you can liabilities

Their bank may also account for their assets and you may debts, and your month-to-month costs, to be certain you could potentially have the ability to take on a mortgage. Property could include:

- Various other properties/possessions you possess

- Quantity of vehicles/automobile you own

- Current financing (car finance, personal bank loan, financial)

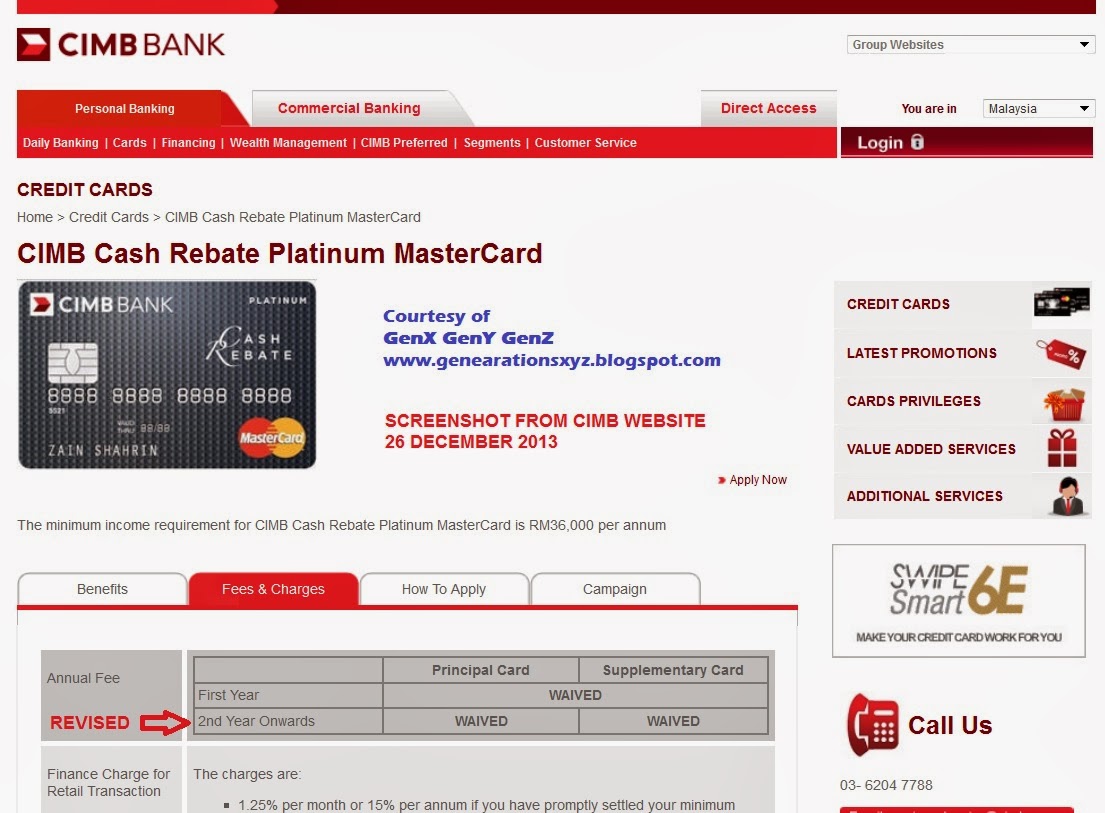

- High mastercard restriction/s

Their financial may also be the cause of a single day-to-go out living expenses like dining, debts, recreation spending or any other monetary responsibilities. In case the cost of living was highest or if you have less throwaway income, their lender can get pick that you can not afford to cope with a beneficial financial. At exactly the same time, if for example the financial obligation-to-income proportion is actually high, as with you may have way too many most other fund/expenses, a loan provider will discover which you are unable to perform a home loan too.

Credit history

Your credit score are a mathematical sign of one’s responsibility as a borrower. Some loan providers are certain to get at least credit history required to meet the requirements for home financing. Normally, the reduced your credit rating, the fresh new unlikely you are becoming accepted to own home financing. Likewise, the greater your credit rating, the much more likely you are to-be approved. You might find a mortgage that have the typical credit rating, but usually, you will need to spend a top interest and get reduced attractive home loan enjoys.

How much cash you’re looking in order to use

Definitely, another significant factor the lender should envision is where much you’re looking to acquire. The lending company will normally pay attention to the matter you need so you can use and how this even compares to the newest home’s worth. So it will be when it comes to the loan-to-value ratio (LVR) and probably having to spend loan providers financial insurance coverage (LMI), and if or not you really can afford to settle your own financial.

Let us quickly http://paydayloanalabama.com/alexandria take a look at a good example. What if we want to use $300,000 into the an effective $400,000 property. It indicates you have got in initial deposit of $a hundred,000 and you will an excellent 75% LVR. Since you have over a great 20% deposit toward household, you won’t need to spend LMI. This is because you might be felt a faster risky’ borrower.

With this in mind, the lender often select perhaps the mortgage is appropriate for you considering your financial situation, property details and every other qualification conditions.

While happy to sign up for a mortgage, chat to our lending specialists otherwise see if you be considered now.

This allows these to see whether you could undoubtedly be able to use the total amount you’ve applied for. The product quality financial worry tolerance is approximately 29% of house earnings (before taxation), definition your instalments will always need to be below 31% of your money.

Deja una respuesta